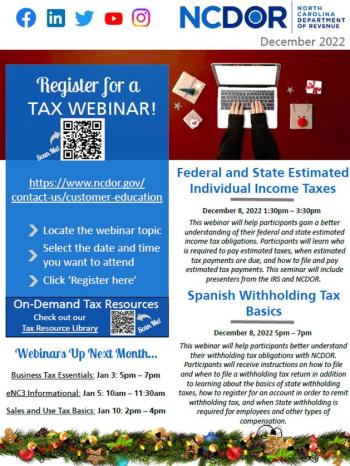

The NC Department of Revenue is offering various webinars for free this month.

Federal and State Estimated Individual Income Taxes

Thu, Dec 8, 2022, 1:30pm-3:30pm - Register now

This seminar will help participants gain a better understanding of their federal and state estimated income tax obligations. Participants will learn who is required to pay estimated taxes, when estimated tax payments are due, and how to file and pay estimated tax payments. This seminar will include presenters from the IRS and NCDOR.

Spanish Withholding Tax Basics

Thu, Dec 8, 2022, 5:00pm-7:00pm - Register now

This seminar will help participants better understand their withholding tax obligations with NCDOR. Participants will receive instructions on how to file and when to file a withholding tax return in addition to learning about the basics of state withholding taxes, how to register for an account in order to remit withholding tax, and when State withholding is required for employees and other types of compensation.

Upcoming Business and Income Tax Seminars

- Business Tax Essentials: Jan. 3, 2023 | 5:00pm - 7:00pm

- eNC3 Informational Webinar: Jan. 5, 2023 | 10:00am - 11:30am

- Sales and Use Tax Basics: Jan. 10, 2023 | 2:00pm - 4:00pm

- Withholding Tax Basics: Jan. 12, 2023 | 3:00pm - 5:00pm

- Spanish Business Tax Essentials: Jan. 12, 2023 | 5:00pm - 7:00pm

- Individual Income Tax Basics: Jan. 18, 2023 | 3:00pm - 5:00pm

- eNC3 Informational Webinar: Jan. 19, 2023 | 2:00pm - 3:30pm

- Business Tax Essentials: Jan. 25, 2023 | 11:00am - 1:00pm

- Spanish Individual Income Tax Basics: Jan. 25, 2023 | 6:00pm - 8:00pm

- Online Seller: Jan. 26, 2023 | 2:00pm - 4:00pm

- Sales and Use Tax Basics: Jan. 31, 2023 | 6:00pm - 8:00pm

Register for a tax webinar at https://www.ncdor.gov/contact-us/customer-education

- Locate the webinar topic

- Select the date and time you want to attend

- Click 'Register here'